To begin using SpotMe, according to Chime: If you choose “credit” when you’re buying something, you won’t be covered with SpotMe. In addition, they don’t ask that you link your savings account to your Chime Checking Account or charge you a fee for SpotMe.įinally, know that SpotMe only covers debit card purchases. That’s why they’ll allow you to overdraft up to $200 with SpotMe without even charging a fee. But as you’ll see in the rest of the review, Chime is different. Most banks offering overdraft protection require you to open a savings account to cover the overdraft or you’ll get bank fees for those overdrafts. It’s also important to know Chime Member Services can’t manually boost your SpotMe limit.Ĭompared to other banks, SpotMe is pretty unique. It’s important to know that any purchase you make that would overdraw your account over your SpotMe limit will be declined. Limits are determined by Chime based on factors such as account activity and history. To be eligible for SpotMe, Chime members who receive a single deposit of $200 or more in qualifying direct deposits to the Chime Checking Account each month. Chime says this tipping helps them offer this service to its members at no strict cost. There isn’t any fee to use SpotMe, but you’ll have the ability to leave Chime an optional tip (note that whether you tip or not will not affect your eligibility for SpotMe) as soon as you repay your negative balance. Chime will “spot” you whenever you want that little extra cushion to cover the cost of a purchase.

#Best checkbook app 2016 free

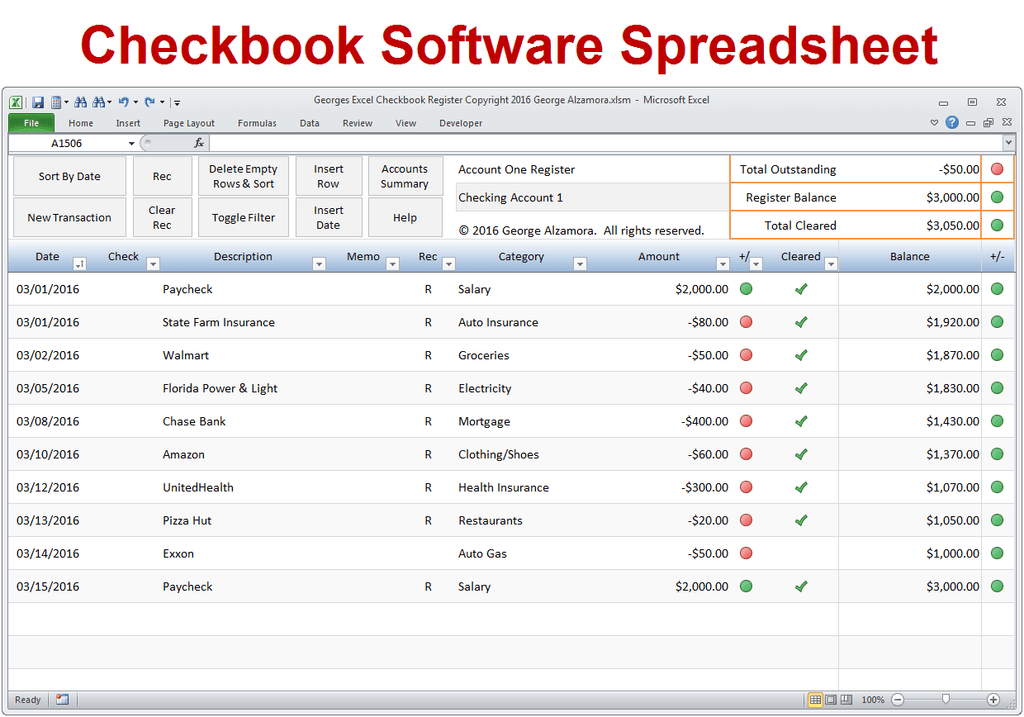

SpotMe lets you make debit card purchases that may overdraw your account free of any overdraft fees. Open a Chime Account Chime Key Features SpotMe® Then, you can choose to keep it there or set up external transfer accounts (there is no charge to transfer cash). Money from your checking account can be transferred to your savings account. You can use that money to make everyday purchases with your debit card, use it online like a standard checking account (to send money), or write paper checks using the Chime Checkbook app. The layout of Chime is simple: everyone that signs up will have access to a checking account (Chime calls this a “Spending Account”), a savings account, and a debit card.Īll the money that you deposit into your Chime account will initially go to your checking account.

It makes things convenient and offers you a streamlined service that’s easy to understand.

If you are sick of having to pay high fees or if you don’t want to deal with overdrafts, then you might be interested in this financial app. One such financial app is Chime.Ĭhime is an online or “mobile-only” app that offers you an alternative to traditional financial managing methods. So, we’ve been seeking banking alternatives that do things in a more customer-friendly fashion.

0 kommentar(er)

0 kommentar(er)